Those in the retail and the restaurants and bars sector would be forgiven for entering 2017 with a sense of trepidation. 2016 was a poor trading year, and whilst restaurants and bars saw a comparatively stronger growth, as costs and inflation began to bite, the forecast for 2017 became subdued. Looking ahead to 2018, disruption will be the prevailing theme, whether it be uncertainty as a result of ongoing BREXIT negotiations, the influence of new technology and increased competition from online channels, Big Data, or changing consumer habits.

Retail

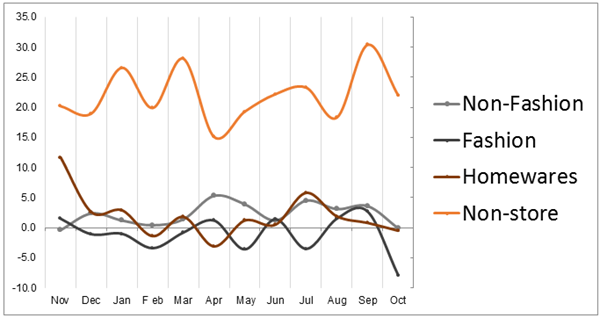

2017, up until October, offered only a slight improvement for the high street and any hopes for a strong start to fourth-quarter trading in 2017 were then dashed by the worst October for more than 10 years. The start of this critical quarter trading saw like-for-like sales falling 5.2% off the back of falling consumer confidence. Unusually warm Autumn weather hampered demand in fashion where like-for-likes fell -7.9% in October 2017. Although fashion will be aided by the recent return to cold weather, LFLs are unlikely to increase enough to mitigate the impact of such a poor October.

Source: BDO High Street Sales Tracker showing LFL sales across categories in 2017.

Restaurants and Bars

Figures from the Coffer Peach Business Tracker showed Britain’s managed pubs, bars and restaurants experiencing a flat trading in October, with both London and regional businesses posting flat growth (0.1% and 0.4% respectively). Pubs and bars posted better like-for-like sales, up by 1.4%, while restaurants saw sales decline by 1.5% nationally. London restaurants suffered the sharpest dip, down by 2.1%, following the 3.2% decline in September.

The flat results for the quarter, coupled with the negative start to the autumn, particularly for London restaurants, adds further pressure to the sector, which has already had to absorb significant cost pressures around property, tax and employment costs, along with the peaking food inflation during 2017.

In November, the Chancellor Philip Hammond made a number of announcements that may impact consumer businesses, including a freeze of alcohol taxes and expansion of discounted business rates which will be welcomed by those in the sector. The Chancellor also included an increase in the national living wage, which will add to the already surmounting costs for the service industries.

Growth is likely to slow next year, as private consumption growth dips and fixed investment is dampened by pervasive uncertainty generated by Brexit. However, a stronger external sector and resilient global demand could cushion the slowdown.

Brexit in 2017 – a bleak and uncertain outlook

There were certainly many important questions to be answered at the start of 2017. What progress would be made on those crucial Brexit negotiations? What would Brexit mean for the future of the workforce and the supply chain? How would consumer spending hold up, as household incomes felt the squeeze of higher inflation and limited wage growth? While most of these questions remain unanswered, consumer spending has, so far, proved surprisingly resilient. That said 2017 wasn’t without its problems.

Unpredictable weather continued to be the scourge of fashion retailers, the country made little headway on Brexit negotiations, higher inflation squeezed disposable income, and rising import and operating costs put further pressure on retailer margins. What’s more, while consumer spending has held up well for most of the year, retail, leisure activities, experiences and dining are all battling to secure their share of the purse. Meanwhile, changes in consumer behaviour and technological advancements continue to disrupt the retail, leisure and dining landscapes and further reinforce the pressing need for businesses to adapt to a new type of consumer.

Retailers in particular are increasingly finding themselves having to strike a balance between being responsive to unexpected short term fluctuations and readying themselves for the longer term structural and disruptive changes that are set to become entrenched features for years to come.

While UK GDP growth in 2017 was stronger than predicted post referendum and retail and consumer spending has not yet taken the hit that was feared. However, Brexit-induced uncertainty continues to overshadow growth prospects and the high level of uncertainty is causing businesses to waver over investment decisions, to the detriment of productivity and economic output. The apparent lack of a unified government stance on the goals and direction of Brexit has only served to compound the problem, which continues to weigh heavily on consumer confidence.

Ongoing input inflation is requiring retailers, restaurants and bars to find ways to protect margins while simultaneously trying to avoid losing customers as a result of higher prices against a reducing level of disposable income. Margins for consumer businesses are expected to fall for 2017 and through to 2019, despite online margins simultaneously growing due to volume benefits and lower cost bases. This will inevitably put further pressure on physical store, restaurant and bar portfolios.

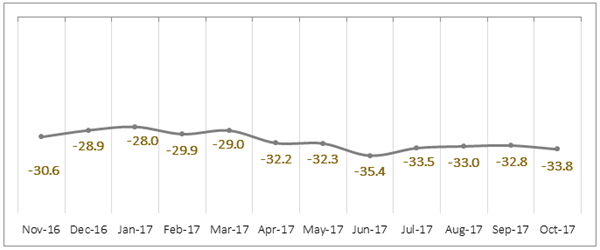

Source: Global Data Consumer Sentiment Tracker for 2017

The negative impact of an uncertain political and economic environment has also resulted in declining consumer confidence and this has been particularly subdued for the past six months culminating in a -1.0ppt decline in sentiment in October alone. Year-on-year, the index is down 0.9ppt, and this doesn’t bode well for Christmas 2017. Last year, festive spending was subdued, and a further decline in consumer confidence could represent a bad omen for retailers, restaurants and bars both over Christmas and into 2018.

Consumer confidence is not expected to improve until there is positive real wage growth and more clarity on what Brexit will look like for the consumer. The impact of Brexit on the consumer purse is only just starting to feed through, and this is likely to make the consumer even more cautious in the short to medium term, so we would not expect the pressure on retailer sales to ease in the short to medium term. Poor consumer sentiment is also likely to precipitate the discounters and disruptors gaining further market share as consumers look to trade down or in different ways.

Weathering the storm in 2018

As we reflect on 2017, we cannot ignore the impacts resulting from the political and economic uncertainty which weighed heavily on the UK economy throughout the year. The consequential effects on consumer confidence and spend would have led many consumer businesses to refocus their strategy to respond to short and medium term impacts.

Whilst we expect that the cost effects of inflationary pressures will ease, sector transformation brought about by technological disruption and a new consumerism will continue to provide both challenges and opportunities to the sector - and if the recent past is anything to go by, at an increasing pace.

So where should consumer businesses concentrate their efforts in 2018?

1. A COLLABORATIVE BUSINESS MODEL

Savvy retailers and restaurants owners will be looking to identify complementary service providers to manage costs effectively and increase market penetration moving forward. This will cover areas such as:

- working in synergy with those that can support elements of their supply chain to protect margins against further cost rises; and

- ensuring that retail stores are positioned alongside complementary brands to encourage footfall and joining forces with others to deliver an enhanced retail, leisure and dining experience for the consumer.

2. EMBRACING TECHNOLOGY

As cost increases take full effect and inflationary pressures on the consumer purse become even more real, those in the sector will be looking at all avenues to protect margins. Looking at the structure of a bricks and mortar retailer next to their online only equivalent, it is impossible to ignore the vast difference in operating model and business structure between the two.

As well as embracing new channels to market and utilising Big Data as a tool to find and retain customers, retailers and restaurateurs should look to innovative technologies to create efficiency, reduce costs and find new routes to the customer.

3. CUSTOMER IS KEY

Whilst 2017 will be viewed as a difficult year, the gap is widening with clear winners in the sector reporting

strong profits and plans for expansion. Brands who have been successful have understood who their consumer is, what they want, how much they’re willing to spend and how they want to be communicated with. Significant financial investments into technology should be customer led to generate the right returns for the longer term; considering not only the consumer of today but understanding who that customer will be tomorrow.